Lessons

The core feature of the product - a systematic approach to traders’ learning and practice. It’s like a guitar with a built-in teacher. It enables you to train your brain to recognize and react to typical trading setups.

According to Daniel Kahneman who was awarded the 2002 Nobel Memorial Prize in Economic Sciences, our unconsciousness can be trained to recognize price patterns and make statistically strong short-term predictions.

A learning process is divided into lessons, from the easiest to more complex ones. But you should note that higher complexity doesn’t mean higher profitability. Most easy, obvious setups get noticed by more people which makes them behave more predictably. The more complex is the setup, the higher is the noise.

So, you should spend more time learning and practicing the first lessons and exercises.

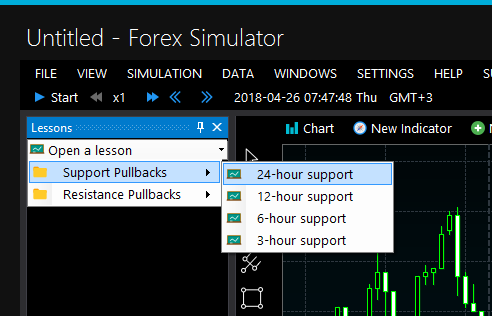

Each lesson is dedicated to a narrow topic, like Resistance Pullbacks, for example.

After you opened the lesson, you will find several exercise sets: from the longest time frames to the shortest ones. You should start with longer time frames because they have highest reversal ranges, they are more obvious and easier to detect. But after you have polished obvious high-level reversals, you should gradually move lower, getting used to recognizing smaller and smaller local reversals.

Each of these time frames has a set of exercises, up to 500 for each ticker. On larger time frames this number may be lower because there are fewer patterns according to price stats.

By switching between tickers, you can load corresponding exercises.

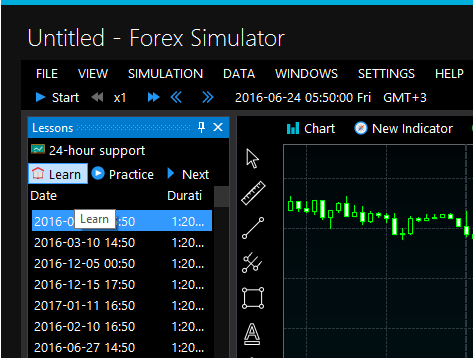

Every lesson has a detailed theoretical explanation, as well as best practices. You can open it by clicking on the Learn button under the lesson name. Don’t skip this step because you will not only learn more but also save time by optimizing your learning process.

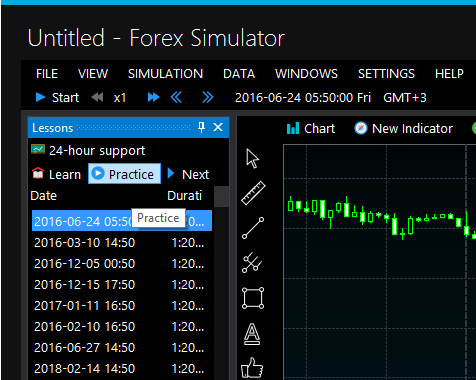

After you have learned enough, select any of the exercises, then click the Practice button. The simulation will automatically rewind to the beginning of the exercise then start playing in real time.

You can trade, speeding up and slowing down the simulation. When the simulation comes to the end of the exercise, it will automatically stop, then you can either continue it or switch to the next exercise.

Any of the exercises can be launched or relaunched from the very beginning by double-clicking on its name. You can do it any number of times you wish. You don’t even need to wait until the end of the exercise. It’s really convenient, especially when you are polishing entry points and stops at the beginning of a new lesson.

Exercises you previously launched will be marked with gray color, so you can skip them in the future. Those that ended with profit will be green, losing ones will be red. It's better to finish all the exercises in the green zone before moving forward.

Exercises are sorted according to their price range. So, the lower in the list, the harder it is to find correct entry points and place tight stop loss orders. It’s a part of the learning process because sharp reversals happen much less often than smaller and smoother ones.

It’s recommended to finish all the exercises for at least a single currency pair before the next lesson. Even after you get tired of setting up orders and stops again and again, just continue to place them mentally, then speed up the simulation to test your ideas. It’s essential because it will fill your brain with information and patterns.

New lessons and exercises will be released in the future, as I learn and polish new trading setups. Please contact me if you have any exercise ideas. I will be happy to develop them.

On the other hand, basic patterns are always more important because they happen much more often and have the highest predictive power. So, plan your time accordingly. It’s better to spend 80% of your time on the first two lessons, than to split it evenly between all lessons.